Climate News and Asset Valuations: Insights from Latin America

IMF Working Paper

Important links

- AI Generated Podcast:

Abstract

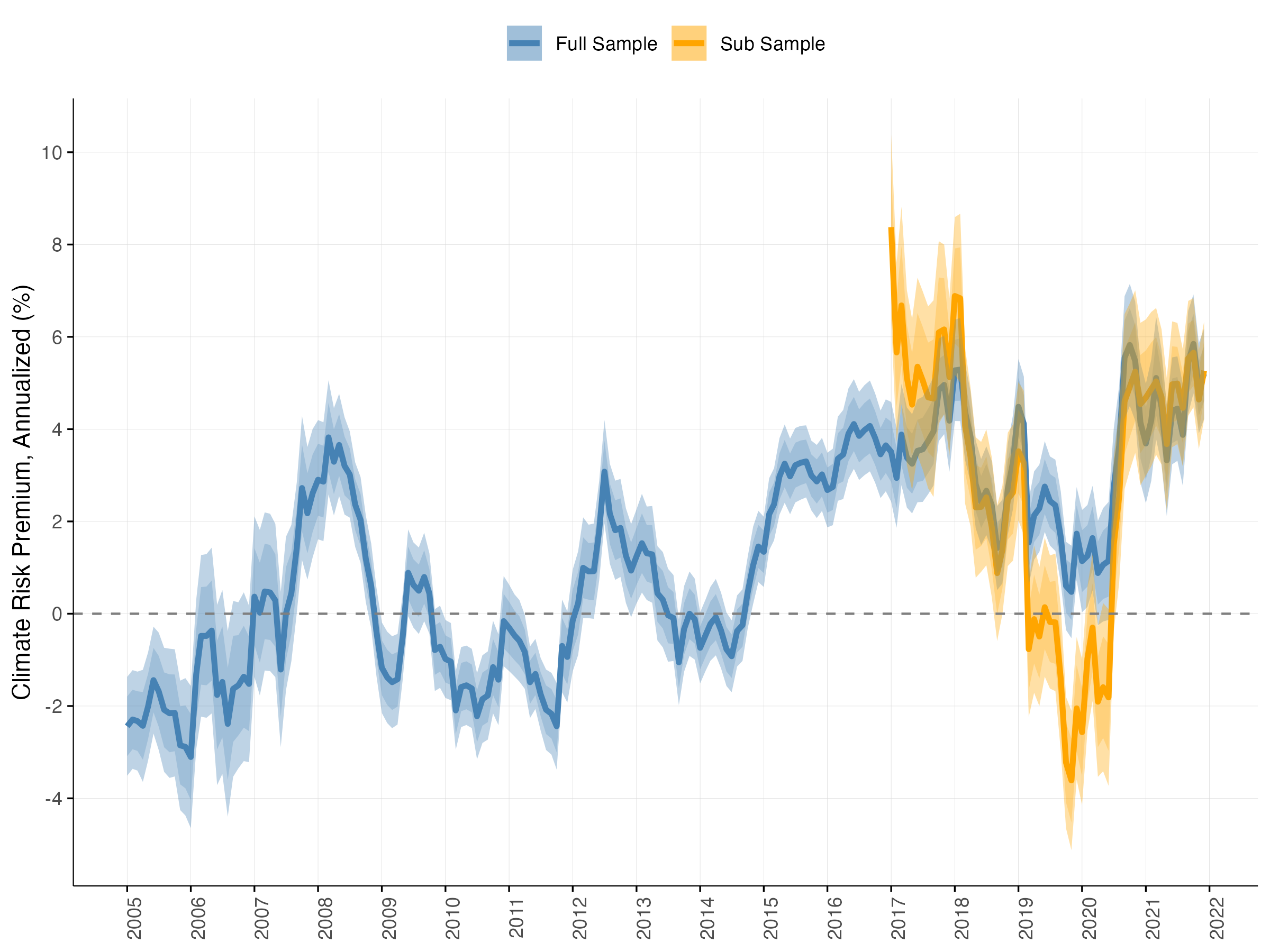

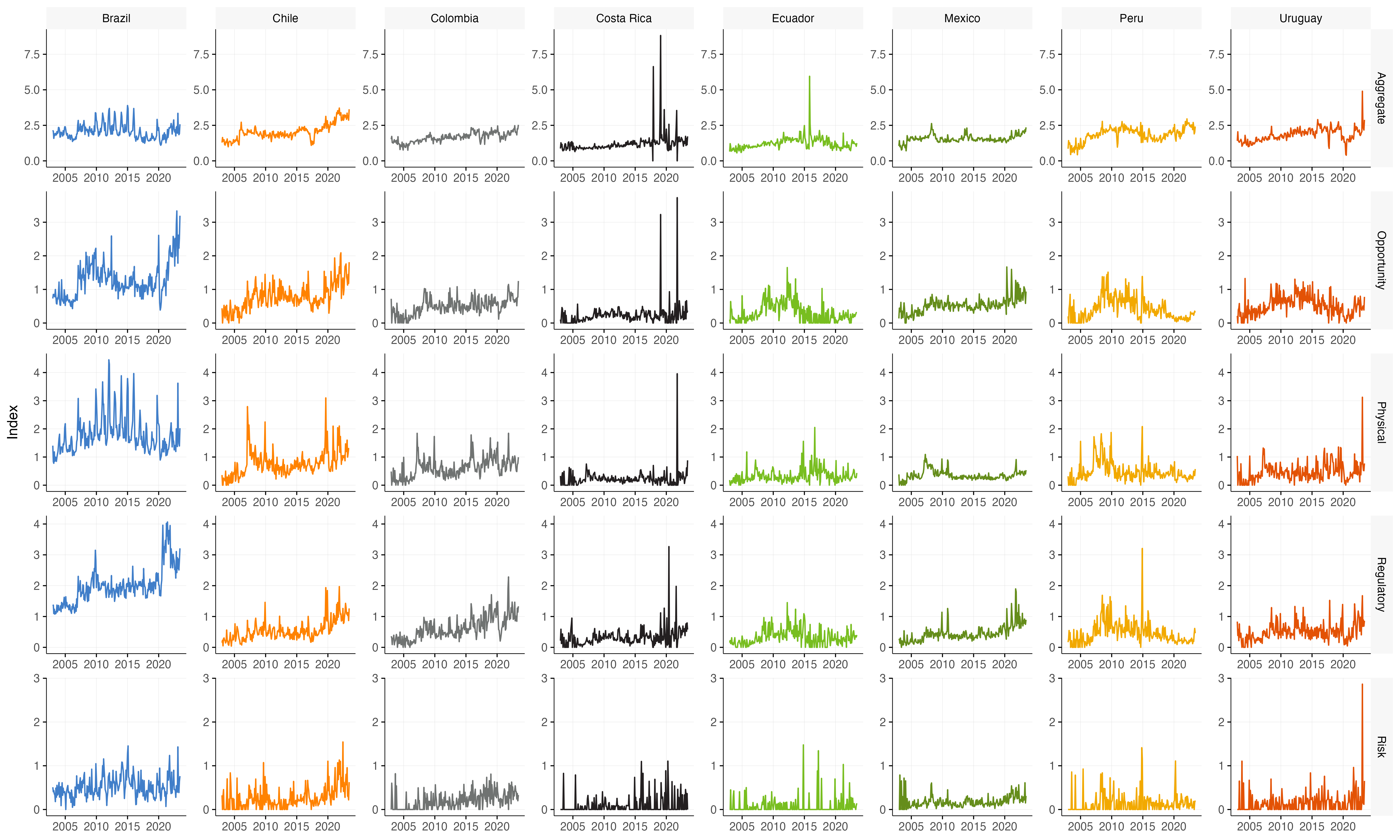

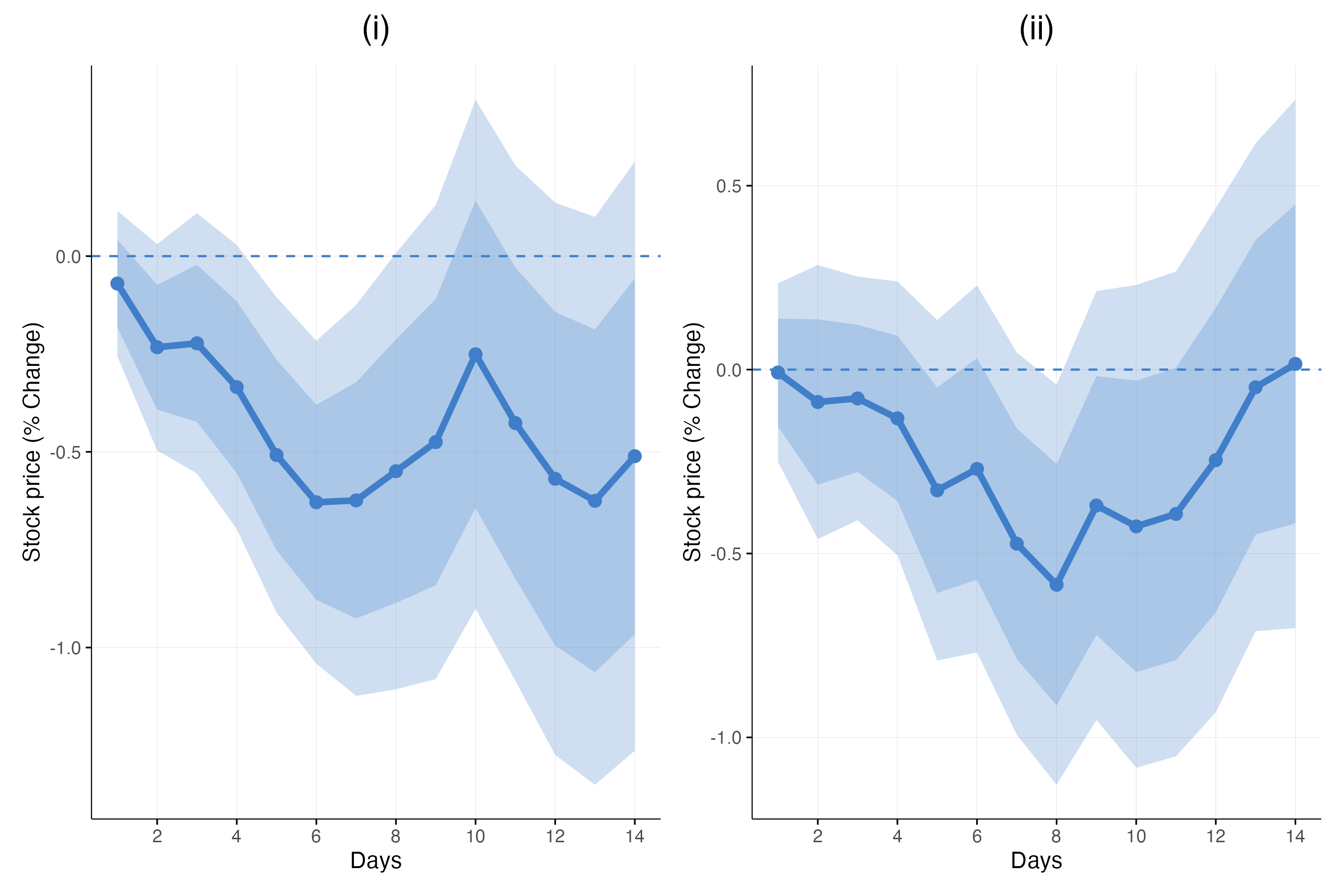

We study the impact of climate-related news on asset prices in eight Latin American countries. We use both newspapers and official announcements to construct daily, country-specific indices via textual analysis, reflecting media coverage of transition risks, climate opportunities, regulatory actions, and physical risks. Leveraging an unbalanced daily panel data set of 628 firms from 2000 to 2023, we find a significant and robust climate risk premium in Latin America, which is higher for “browner” firms and has increased in more recent years. Focusing on major climate policies announced in official gazettes after the legislative process has been completed, we show that the publication of the laws is associated with a protracted decline in the relative stock prices of high-emission firms.

Key figures

Climate change exposure measures

Differential responses between brown and green firms to regulatory news

LaTeX

@article{Ciftci2025Climate,

author = {Ciftci, Muhsin},

journal = {IMF Working Papers},

doi = {10.5089/9798229000932.001},

issn = {1018-5941},

number = {037},

year = {2025},

month = {2},

pages = {1},

publisher = {International Monetary Fund (IMF)},

title = {Climate {News} and {Asset} {Valuations}},

url = {http://dx.doi.org/10.5089/9798229000932.001},

volume = {2025}

}Word

Muhsin Ciftci, and Christina Kolerus. "Climate News and Asset Valuations: Insights from Latin America", IMF Working Papers 2025, 037 (2025), accessed March 5, 2025, https://doi.org/10.5089/9798229000932.001